Management fee setup guide for property management companies

Management fee quick tour for property management companies

How property management companies operate

When providing managed services, property management companies (or brokerages) offer one-stop services—property management, leasing, maintenance coordination, accounting—and charge owners a management fee or leasing commission.

After successfully renting out a unit for an owner, the agency calculates the management fee from rent income and creates complete accounting data for reconciliation and analysis.

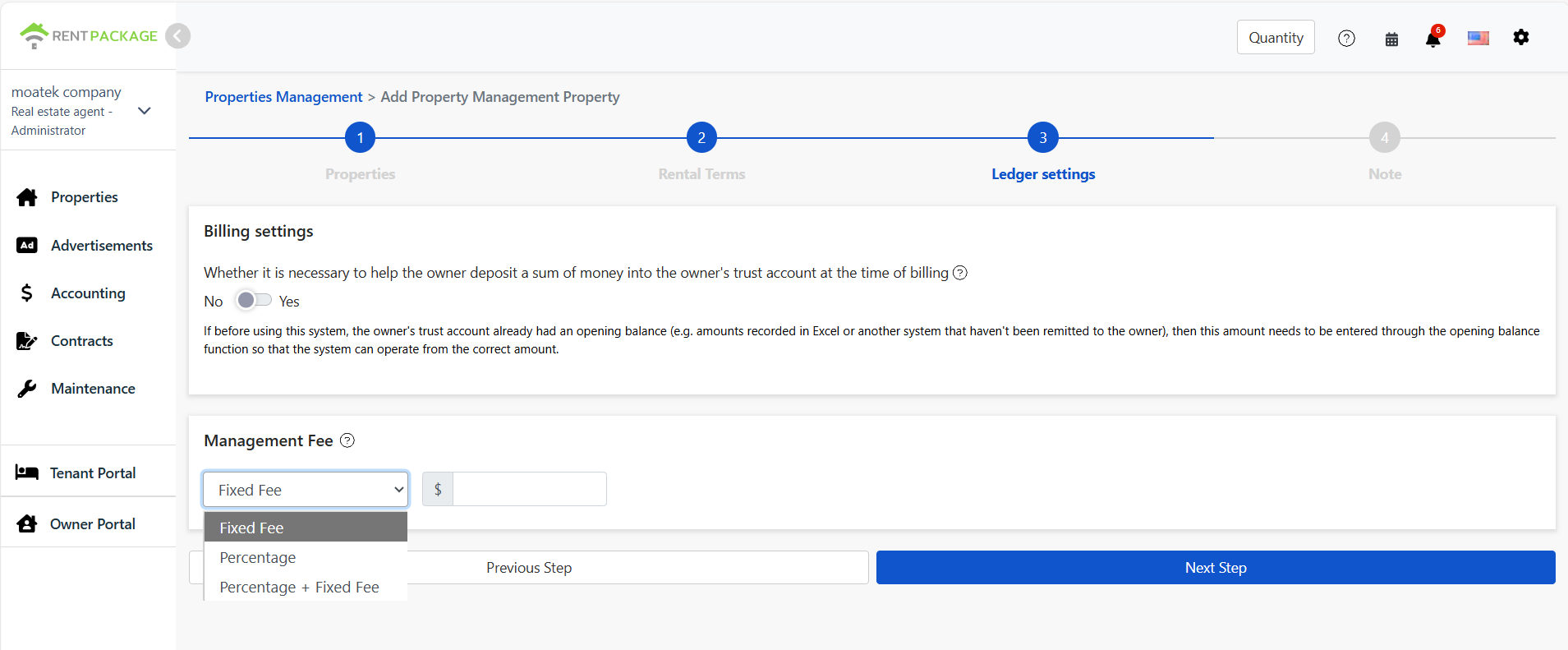

How are management fees calculated? Three billing methods to choose from

In our system, when adding a managed property, set its management fee formula. We support these common methods:

- Flat fee:collect a fixed monthly amount, e.g., $1,000.

- Percentage:Calculate as a share of rent (e.g., 10%) with min/max limits.

- Percentage + flat fee:for example: 10% + $300.

Where to set management fees? Do it when adding the property!

When you add a managed property, configure its fee method. Works for single units or whole buildings.

These settings auto-apply to future tenant leases for that property, saving re-entry time.

Billing cycles auto-generate when creating a tenant lease

When creating a tenant lease, enter:

- Rent amount

- Payment frequency (e.g., weekly / monthly / quarterly)

- Lease start and end dates

The system will automatically generate:

- Tenant rent schedule: lists each period’s rent due and payment deadline.

- Owner management fee schedule: calculates amounts due per the property’s fee formula.

Want accounting on autopilot? Start using our system now.

Our smart property management system saves you from tedious accounting—from property setup to tenant leases—automatically generating tenant and owner bills, the best partner for every agency owner!